By Sam Brooks – Private Client Adviser.

Investment bonds, also known as insurance bonds, are investments offered by insurance & investment companies and friendly societies. They have features similar to a managed fund combined with an insurance policy and can be a tax effective way to invest for the long-term if certain rules for making contributions and withdrawals are followed.

Here we explain how investment bonds work so you can decide if they could potentially be right for you.

Most investment bonds offer investment options such as cash, fixed interest, shares, property, infrastructure or a range of diversified investment options, with risk levels ranging from low risk to high risk. The value of the investment bond will rise or fall with the performance of the underlying investments.

10 Year Tax Rule

For Australian Citizens, whether they live and work (and are taxed) in Australia or not, holding an investment bond for 10 years or more can be a very tax efficient way of saving and investing for the long term. This is because Australia has a unique rule whereby all income and growth on an investment bond is paid free of tax on redemption once it has been held for 10 years, so long as certain criteria is met.

The criteria being that no withdrawals are made within the ten year period and that any further investments into the policy do not exceed 125% of the previous year’s contributions. If you make regular contributions into your investment, the ten year period starts and finishes on the anniversary of the initial investment only (i.e. you can pay into a regular savings policy with a term of ten years and close the policy free of tax after just ten years).

Who Benefits?

Investment bonds are tax paid investments. This means when earnings on the investment are received by the insurance company, they are taxed at the corporate tax rate (currently 30%) before being reinvested in the bond

If you live, work and pay tax in Australia and have a marginal rate of tax over 30% an ‘Onshore’ Investment Bond may be a very tax efficient means of saving for the long term.

Benefits to Expats

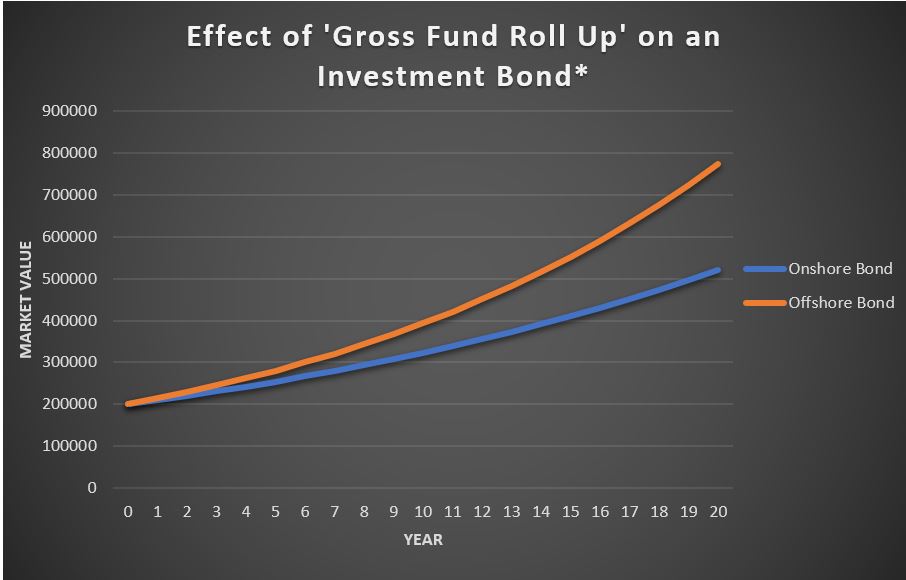

If, however, you live and work abroad then an ‘Offshore’ Investment Bond becomes an even more attractive proposition from a taxation point of view. Unlike an Onshore Investment Bond, an Offshore Bond grows free of corporation tax, and as such, the growth on a like for like investment is 43% per year higher for expats. This is known as “Gross Fund Roll Up”.

This gross fund roll has a large positive effect on long term compounded returns.

Case study

Two investors, both Australian citizens, one based in Australia and one based in Qatar, both invest $200,000 AUD for the long term and make no withdrawals. The underlying investment fund returns 7% per year after charges:

*Assumes a like for like investment fund returning net of charges returns of 7% per year on an initial $200,000 AUD lump sum investment

Whilst the two values remain similar in the early years, by year 10 the Offshore Bond investor would have an out-performed the onshore investor by $70,740 and if they both left their investment in place, by year 20 this out-performance would have increased to $253,294 simply by making use of a tax efficient investment wrapper.

The return on encashment for the offshore investment would be paid free of any tax at any point from year 10 onwards whether the investor had returned back to Australia in the 2nd year or the 15th so long as the bond was left in place.

If you are an Australian citizen or looking to retire in Australia, and would like more information on tax efficient investments available to you, contact us on admin@w1invest.com and one of our advisers will get in touch.