By Nathan Sweeney –

“It goes without saying that markets

have been challenging this year, but

history tells us we may be closer to the

end of the downturn than the beginning.”

Nathan Sweeney

Deputy Chief Investment Officer of Multi-Asset

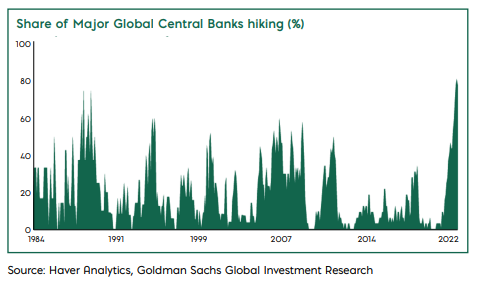

As we started the year’s second half, investors were optimistic that inflation would begin to be tamed. It does appear to have peaked, at least in the US, which is further along in the cycle. Unfortunately though, inflation is not falling quickly enough for the liking of anyone, particularly central bankers. Outside the US, inflation is still rising. Central bankers across the globe are trying to bring it under control in the only way they know how, by raising interest rates, and for now there is no let-up in the pace of rate hikes. Unfortunately, this directly increases the likelihood of a recession. Simply put, higher interest rates increase costs, which squeeze your wallet, causing you to consume less. In the face of lower demand for their goods, retailers are forced to respond by lowering prices to attract consumers, ultimately reducing inflation. So, have your spending habits changed? You will know this only too well if you have a mortgage linked to bank rates or are looking to refinance any time soon. Mortgage rates in the US and the UK are both north of 5%. For Professional Clients only. Not for distribution to or to be relied upon by Retail Clients. Multi-asset team Q3 market insight October 2022 Equity markets have made little headway during the quarter and, in some cases, have retested or broken through the lows set in June. Fixed income markets have also experienced further volatility, ultimately due to the pace and size of interest-rate rises across most developed countries. Globally, 80% of central banks are now raising interest rates versus virtually none in 2020. During the last interest-rate rising cycle in the US, interest rates were increased nine times over four years in small increments of 0.25%, totalling 2.25%. Today, interest rates have risen by 3% in just over six months. Hence, the tantrum in bond markets. The quarter ended on a somewhat sour note, as conflicting policies in the UK spooked investors. On the one hand, the Bank of England (BoE) is raising interest rates to fight inflation. But, on the other hand, the UK government has implemented significant tax cuts to stimulate economic growth – and that is seen as inflationary

As a result, UK government bonds experienced historic swings following the announcement of the tax cuts. Bond yields rose amid worries about a deterioration in the UK government’s public finances. However, markets then eased after the BoE said it would make temporary purchases of long-dated bonds on whatever scale is necessary to restore orderly market conditions. The £65bn bond-buying plan involves daily purchases of up to £5bn of long-dated bonds until October 14, unless market conditions materially change.

So, what is next for markets? The multi-asset team believes there are several areas to pay close attention to – and a number of reasons for investors to be optimistic.

Inflation

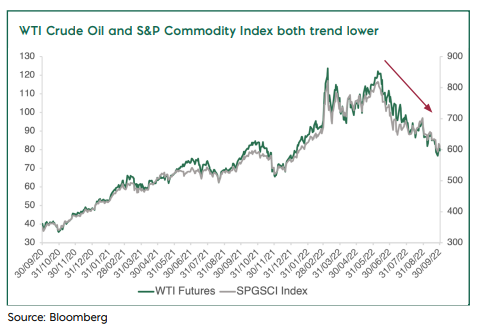

There is no doubt inflation is high, but we are more interested in the direction of travel. Inflation in the US peaked at 9.1% in June and is now 8.3%, and several increasing costs that contributed significantly to rising inflation have now begun to fall. These range from cargo shipping container costs to petrol prices:

- Cargo shipping costs have fallen 61% since reaching a high in September 2021

- The oil price has fallen below $80, having been as high as $119 in March

- House prices have also been softening as interest rates rise

Increases in the costs listed above have contributed to the dramatic rise in inflation that we have seen this year; equally, these factors will contribute to falling inflation in the months ahead. Inflation has been easing since June in the US, and the recent energy support packages in Europe and the UK are likely to lead to inflation peaking soon in these regions.

Interest-rate rises

High inflation has been the key contributing factor to global interest-rate rises this year. Central banks’ forecasts for interest rates tell us that most interest-rate rises are expected to be behind us by the end of this year. We are now closer to the end of this interest-rate-rising cycle than the beginning. Notably, markets can move forward once they know what they are dealing with. Historically, markets have tended to outperform as they approach the last 1% of interest-rate rises.

Recession

One of the major drawbacks of rising interest rates is a slowdown in consumption. Consumer spending is one of the most significant contributors to economic growth. The aggressive increases in interest rates and inflation are eating into consumers’ disposable income, which means less spending on everything else. However, the jobs market in many areas remains exceptionally resilient, and the banking and financial systems are structurally sound

Despite this, recession is now expected in many regions across the globe. However, this has been well advertised by many market commentators, and is reflected in asset prices

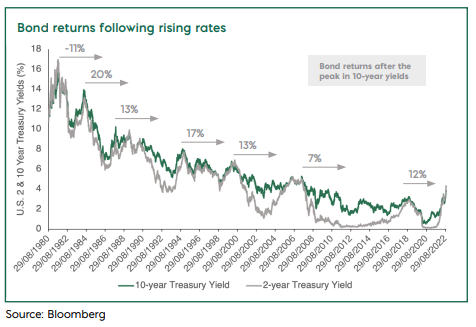

Portfolios

From a portfolio management perspective, one of the significant benefits of rising interest rates is the return of income across bond markets. For over a decade, investors have been starved of income. We have spoken in the past about the era of TINA (There Is No Alternative – the decade of low growth, low inflation and low rates, during which equities were the only game in town). We are now transitioning to TARA (There Are Reasonable Alternatives) and the game has changed, especially for incomehungry investors. For many years, dividends were the only way to get any form of income, but you can now get very attractive levels of income from bonds, with lower risk than equities. These income levels might not beat inflation at current levels, but if you assume that inflation will eventually come down – particularly with the prospect of recession becoming increasingly likely – then bonds bought at current yields should deliver a handsome return. With this in mind, we are – slowly – increasing the duration in portfolios

FUND IN FOCUS

Jupiter Asian Income

Manager: Jason Pidcock

- Jason Pidcock has 28 years of experience managing Asian income equities and has built a strong reputation by doing this successfully.

- His focus is on companies with solid balance sheets, sufficient free cash flow, and good governance.

- The fund has outperformed its benchmark over 1-, 3- and 5-year periods.

- The fund provides good downside protection in volatile markets.

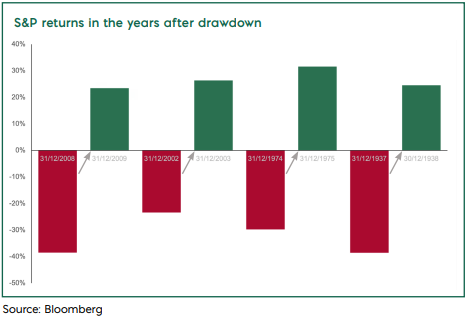

It goes without saying that markets have been challenging this year, but history tells us we may be closer to the end of the downturn than the beginning. We will watch inflation, interest rates, earnings and valuations as key indicators that could signal a bottom in financial markets. However, in the meantime, we expect markets to remain volatile, and are positioned defensively to cushion the impact on portfolios. However, let us end on a positive note. Since 1935, every time the S&P has fallen more than 20% in a calendar year, the returns in the following year have been positive, and by an average of about 25%. As we all know, market falls can provide attractive opportunities for long-term investors.

Risk Warnings

Capital is at risk. The value and income from investments can go down as well as up and are not guaranteed. An investor may get back significantly less than they invest. Past performance is not a reliable indicator of current or future performance and should not be the sole factor considered when selecting funds. Our funds invest for the long-term and may not be appropriate for investors who plan to take money out within five years. Tax treatment depends on individual circumstances and may change in the future.

Regulatory Information

This material is for distribution to professional clients only and should not be distributed to or relied upon by any other persons. It’s provided for general information purposes only and is not personal advice to anyone to invest in any fund or product. The Key Investor Information Documents and the Prospectuses for all funds are available, in English, free of charge and can be obtained directly using the contact details in this document. They can also be downloaded from www.marlboroughfunds.com. An investor must always read these before investing. Information taken from trade and other sources is believed to be reliable, although we don’t represent this as accurate or complete and it shouldn’t be relied upon as such. Calls may be recorded for training and monitoring purposes. Issued by IFSL International Limited, authorised by Central Bank of Ireland and incorporated in Ireland as a limited company with company no. 616854. Directors: Raymond O’Neill (Irish), Brian Farrell (Irish) and Dom Clarke (British). Registered office: IFSL International Limited, 7/8 Mount Street Upper, Dublin 2, Ireland.